“Catastrophic” mismanagement by the military junta has triggered a full-scale banking crisis, claims a devastating new report by a group of independent financial experts.

In a damning assessment, the Independent Economists for Myanmar (IEM) argued: “State Administrative Council’s (SAC) management of the crisis has been incompetent, and potentially even designed to ruin some banks.”

Myanmar’s banking sector was perilously weak after decades of exploitation by the military and its crony businesses, IEM said.

Now the coup has turned banks into “zombies” because the value of their assets “appear to have fallen below the level needed to cover deposit liabilities”.

The IEM’s members, whose identities have not been made public, include economists and financial experts who have worked for the government or banks in Myanmar.

They argue the military regime has made things worse by:

-

Arresting four of Myanmar’s leading financial experts;

-

Suspending more than two hundred staff at the Central Bank of Myanmar (which regulates the banking system);

-

Stopping depositors from accessing most of their money; and

-

Using threats of arrest to force people to place their cash into banks.

As Myanmar’s economy descends into chaos with cash machines regularly emptying by 11am, “a full collapse of the banking sector was only narrowly avoided as a result of staff strikes by bank employees, branch closures, consumer boycotts and internet outages slowing the speed of cash withdrawals and interbank transfers”.

Since the coup, depositors face lengthy queues – sometimes overnight – to withdraw tightly controlled small sums.

As cash supplies dry up, buying scarce supplies of oxygen and medicine in the midst of the pandemic is impossible for many people, the IEM said.

“Military leaders’ heavy-handed attempts at stabilizing the sector through coercion have not only failed to stem the outflow of cash but have further undermined public confidence and banking stability,” IEM said in its “Myanmar’s Banking Crisis” report .

The World Bank expected Myanmar’s economy to contract by almost a fifth, even before the latest surge of Covid-19, and the impact of the banking crisis on the economy “cannot be overstated” and would last for years, IEM said.

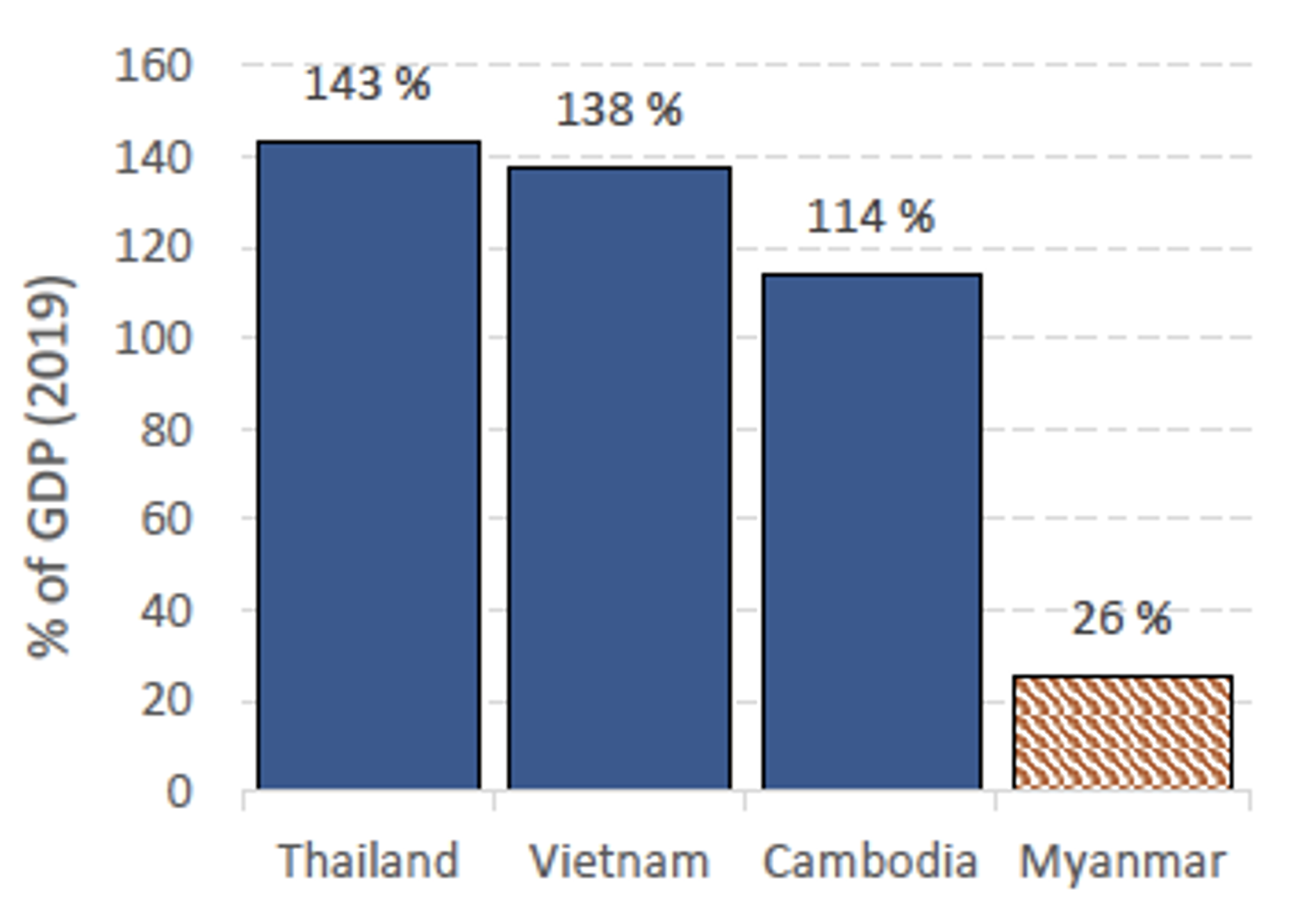

Myanmar’s commercial banking industry is small and concentrated in the cities: only about one in four of the country’s people have a bank or mobile money account, with most people not trusting the banks and preferring to use cash.

Even so, the effects of the banking crisis are felt across the country as less money is flowing out of the cities to rural communities in the form of remittances or payments for farm products like food.

“Without access to their deposits, people cannot spend to drive the economy, or even to feed themselves. Without bank lending, investment is curtailed. Wages are going unpaid, business revenues are declining and borrowers are finding it increasingly difficult to make loan repayments” which makes the banks even weaker, IEM said.

IEM called on the military regime to hand over control of the banking sector to an independent body which would restructure the banks and try to bring in more investment to the industry to restore its finances.

Bottom of the league: Domestic credit to private sector (% of GDP)

It is highly unlikely, however, that the regime will give up control of the banking system which it uses to finance its military power.

“Clearly the fastest way to re-establish financial sector confidence would be to restore democracy and for the military to return to the barracks,” IEM concluded.

In its report, the IEM warned that “recent rules limiting kyat withdrawals and threatening internet privacy, and thus mobile-money transactions, only push Myanmar further into a cash economy, shrinking credit and repressing economic activity.”

It drew attention to the European Commission placing Myanmar on its list of states that pose a high risk of money laundering and terrorism financing.

The independent experts strongly criticised the Central Bank of Myanmar (CBM). Before the coup, the CBM “failed to sufficiently manage risks, conduct adequate due diligence when lending, or build up precautionary reserves. For instance, they are overexposed to Myanmar’s particularly volatile real-estate market and suffered from high non-performing loan ratios even before the coup and COVID-19.”

- This is a Myanmar Now story in association with Finance Uncovered.

![Resistance fighters holding heavy weapons ammunition in central Myanmar. (Photo: Freedom Revolution Force [FRF])](https://myanmar-now.org/en/wp-content/uploads/sites/5/2024/04/438869056_443267851680128_1706386881626943924_n-390x220.jpeg)